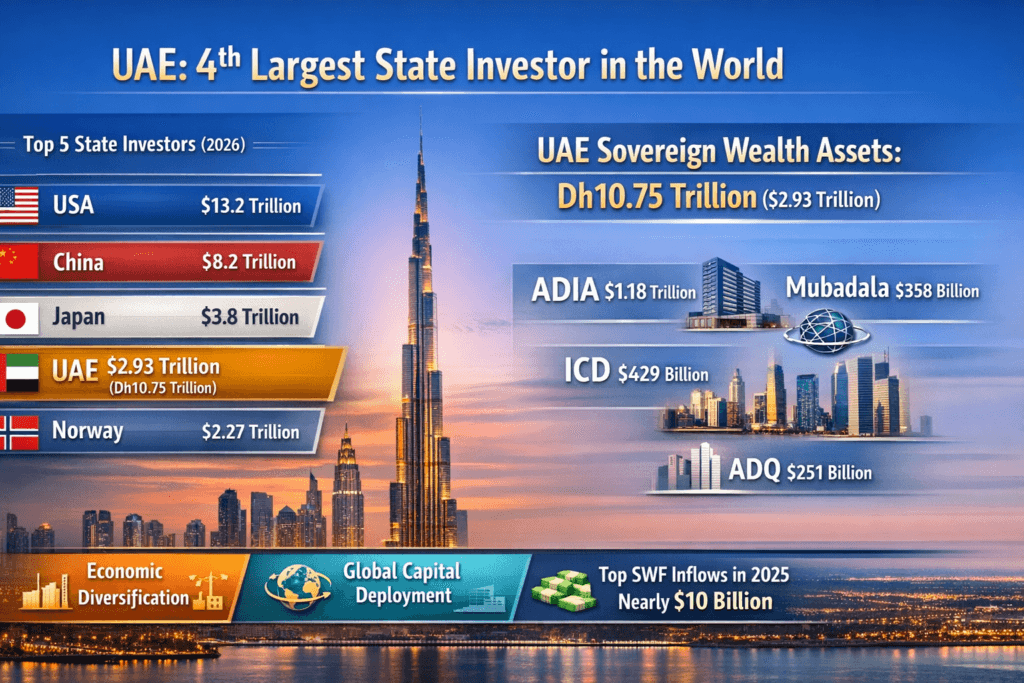

ABU DHABI — It’s official: the United Arab Emirates has just cemented its place at the very top of the global financial ladder. As of this week, the UAE is now the world’s 4th largest state investor, managing a staggering Dh10.75 trillion ($2.9 trillion) in sovereign wealth assets.

The figures come straight from the Global SWF 2025 Annual Report released on January 1, and honestly, they confirm what many of us on the ground have been seeing for years. The UAE isn’t just participating in the global economy anymore—it’s shaping it. Trailing only the US, China, and Norway, this ranking shows just how successful the UAE government investment portfolio has been at moving the country’s wealth beyond oil.

Table of Contents

Global State Investor Rankings: A Meteoric Rise

The 2025 report highlights a pretty dramatic shift in where the world’s money is sitting. While the US and China are still the heavyweights you’d expect at the top, the UAE has quietly but aggressively consolidated its wealth to leapfrog other major economies.

This didn’t happen by accident. It’s the result of a very deliberate UAE capital deployment strategy over the last decade. The government has been taking oil surpluses and channeling them into sectors that actually have a future, effectively building a financial safety net that protects the local economy when global markets get shaky.

Here is the snapshot of where we stand:

- Global Rank: 4th Largest State Investor

- Total Assets (AUM): Dh10.75 Trillion ($2.9 Trillion)

- Key Growth Drivers: AI, Digitalisation, and Global Infrastructure

- Primary Funds: ADIA, Mubadala, ADQ, and ICD

- Primary source: Global SWF annual rankings (2026)

- Focus areas: Long-term returns, economic diversification, global capital deployment

Abu Dhabi: The “Capital of Capital”

If you look at the breakdown, the real engine room here is Abu Dhabi. The emirate has effectively earned its nickname as the “Capital of Capital,” with its sovereign wealth funds (SWFs) holding the vast majority of those Dh10.75 trillion state assets.

You have the Abu Dhabi Investment Authority (ADIA), which has always been the disciplined, quiet giant anchoring the portfolio. Then there’s Mubadala Investment Company, which has taken on a much more visible role recently. They’ve become one of the most active dealmakers globally—especially if you look at their moves in tech and life sciences.

“The UAE’s ascent to the fourth spot globally is not just about asset accumulation; it is a testament to the strategic deployment of capital into future-ready sectors like Artificial Intelligence and renewable energy,” noted analysts regarding the Global SWF findings.

Strategic Investments and Future Outlook

What’s really interesting in the report is where the money is going. UAE strategic investments have pivoted hard toward the future. Throughout 2025, we saw billions flow into artificial intelligence and digital infrastructure.

Mubadala, for instance, didn’t just dip a toe in; they led the charge with a massive $12.9 billion investment in AI and digitalisation projects. It’s a clear signal that the leadership’s “We the UAE 2031” vision is in full swing. The goal isn’t just to buy shares in tech companies—it’s to ensure government-owned investment arms own a piece of the infrastructure that will run the next generation of the global economy.

Dubai’s Contribution

Of course, it’s not just an Abu Dhabi story. Dubai state investment arms are a huge part of this ranking, too. The Investment Corporation of Dubai (ICD) has been strengthening the national portfolio with solid assets in aviation, transport, and real estate, which really rounds out the UAE’s global investor position.

On the Dubai side:

- Investment Corporation of Dubai (ICD) – around $429 billion

- Emirates Investment Authority, Dubai Holding, and others add meaningful scale

Looking ahead to 2026, the trend line for UAE sovereign wealth funds is only pointing up. The strategy is clear: diversify now, invest aggressively, and secure a spot as a primary architect of the future global economy.