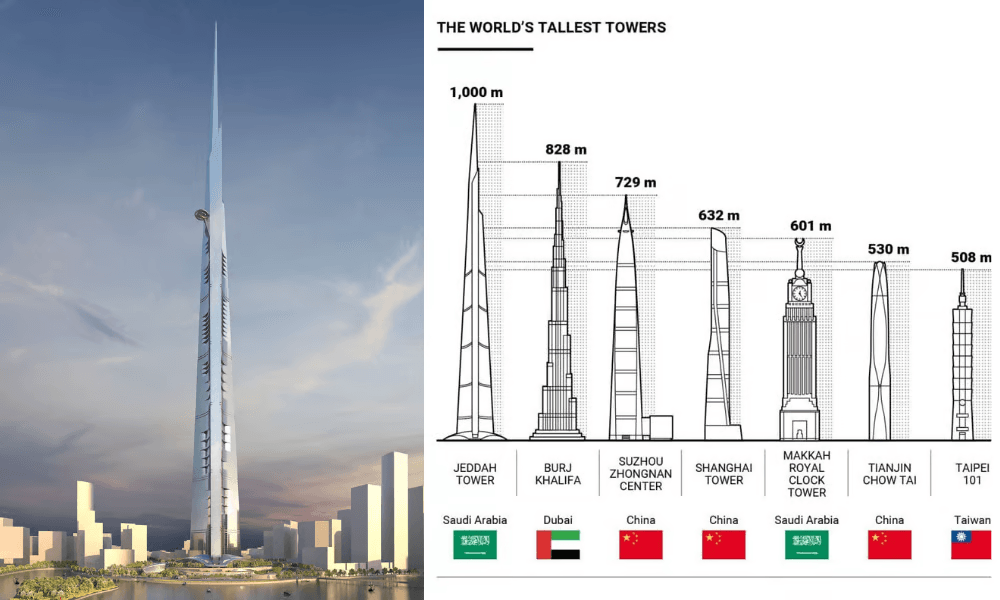

Dubai’s skyline icon still stands at 828 metres, but the chatter is real: Burj Khalifa losing its crown looks increasingly likely as Saudi megaprojects move forward. This isn’t only about bragging rights. It affects tourism, regional branding, and where big money decides to park.

Table of Contents

Current Status of Burj Khalifa in 2026

Burj Khalifa remains the tallest completed building at 828 m and still brings crowds to Downtown Dubai. The tower marked another anniversary in January 2026 with events that reminded people why it matters — to hotels, to tour operators, to retailers. It’s very much in use, and it still draws attention worldwide.

The Projects Closest to Breaking the Record

Jeddah Tower Construction Progress

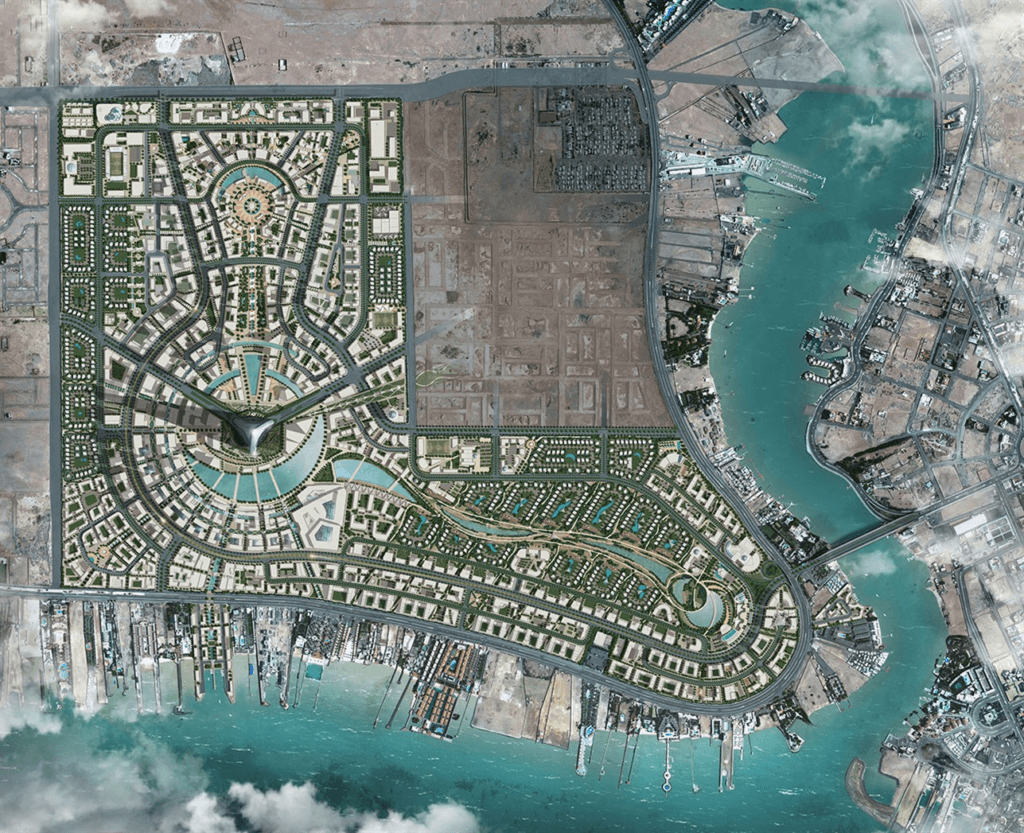

What it is: A kilometre-plus mixed-use tower inside Jeddah Economic City.

Current condition: Work has restarted after long delays. By early 2026, crews pushed the core well into the superstructure. Developers are publicly targeting finishing works in the second half of the decade, with 2028 often cited as a realistic window if momentum holds.

If Jeddah Tower tops out above 1,000 metres, it will claim headline status from Dubai. Expect short-term tourism and marketing shifts, but not an overnight loss of Dubai’s broader leisure and events edge.

Rise Tower Planning and Procurement Status

What it is: A proposed megatall tower in Riyadh’s “North Pole” district — concepts near 2,000 m.

Current condition: The Public Investment Fund has been running procurement and inviting bids for planning. It’s still at the design and procurement stage rather than actual tower construction. Delivery, if it happens, looks more like a 2030s story.

Rise Tower signals scale and intent. It’s a strategic play by Saudi planners, not an immediate threat to Dubai’s tourism machine. But the existence of such projects raises the stakes in Gulf-wide investment and branding.

Government Strategy and Institutional Backing

Saudi backing and Vision 2030

Saudi megaprojects are tightly linked to state strategy. Jeddah Tower is part of Jeddah Economic City and tied to Vision 2030 goals. That government backing helped unlock financing and get crews back to work.

At the same time, the Public Investment Fund is fronting ultra-large schemes like Rise Tower. They’re calling the shots on timelines and tenders. On Dubai’s side, Emaar and other developers are not idle. They keep making deals and repositioning assets as markets change.

Engineering and Construction Realities

Foundations for a 1,000m tower aren’t ordinary. They need deep piles and major soil work — especially on the Red Sea coast. You can see why the early years went into ground preparation.

Wind is a stubborn challenge. Engineers use tuned mass dampers, buttressed cores, and clever shapes to tame sway. Burj Khalifa set a high bar; newer towers build on that work.

Then there’s logistics. Façade panels, crane lifts, elevator cores — they set the pace. On Jeddah’s site, more cranes and visible core work tell you momentum has returned. But fit-out, elevator testing, and safety sign-offs still take time.

Projected Timeline Outlook

- Short term (2026–2028): Jeddah Tower is the most likely to eclipse Burj Khalifa if progress holds.

- Medium term (2028–2035): Projects like Rise Tower remain possible but depend on approvals, funding, and long lead times.