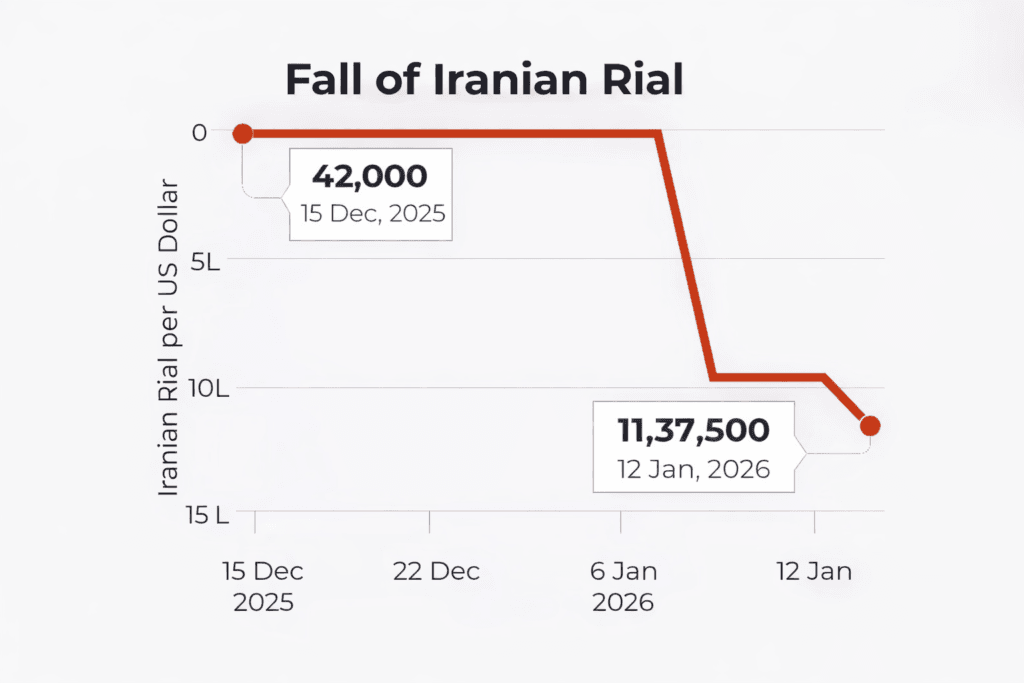

Tehran, Jan 14, 2026 – Iran’s economy was rocked as the Iranian rial plunged to historic lows and inflation surged, triggering rare mass protests. By Jan. 6, the US dollar was trading near 1.47 million rials on unofficial markets. Official data show consumer inflation topping 42% in December 2025, driven by sharp rises in food, rent, and fuel costs. Widespread anger over the soaring cost of living exploded into what some analysts call a “winter uprising,” beginning at Tehran’s Grand Bazaar on Dec. 28 and rapidly spreading to other cities. The turmoil exposes deep economic strains – many experts warn that the currency crisis of 2026 reflects structural problems in Iran’s economy more than short-term market moves.

Table of Contents

Social and Market Impact

- Currency crash: The rial is at historic lows – about 1.47 million per USD (Jan 6), erasing roughly half its value in 2025. The informal Rial to USD exchange rate gap has widened as people flee to dollars and gold as safe assets.

- Inflation surge: Iran’s hyperinflation is biting. Official inflation reached ~42% in Dec 2025. Year-on-year prices for food and essentials jumped ~72%, straining household budgets.

- Nationwide unrest: Protests began Dec 28 in the Tehran bazaar over the rial’s devaluation. Within days, tens of thousands of shopkeepers, workers, and students marched in over 30 provinces. Demonstrators burned images of Iran’s Supreme Leader and chanted “Death to the dictator,” even under live fire. Rights monitors report hundreds killed and thousands arrested in the crackdown.

- Economic control: Powerful IRGC-linked firms dominate Iran’s economy. Critics note that only the Guard network reliably accesses foreign currency. A Tehran trader said bluntly, “We cannot import goods … only the Guards or those linked to them control the economy.” This parallel system amplifies market distortions and fuels public anger.

- Sanctions shock: The UN “snapback” sanctions (Sept 2025) reinstated arms embargoes and asset freezes on Iran. Western and EU sanctions targeting Iran’s nuclear program and drone exports have sapped oil revenue. Data journalism groups estimate Iran lost roughly $5 billion in potential oil income in 2024–25 due to sanction-evasion costs. Discounted sales via shadow tankers have kept forex earnings far below needs.

- Fiscal strain: Iran’s budget is deeply unbalanced – the shortfall was projected at around 1,800 trillion tomans (tens of billions USD). Oil (at about $60/barrel) remains the main forex source, but revenues are insufficient to fund subsidies or imports. The World Bank foresees GDP shrinking by ~1.7% in 2025 and 2.8% in 2026, which could further tighten the budget. In this context, imported goods costs rise sharply on the weaker rial.

- Living costs: Ordinary Iranians face rampant inflation and shortages. Weekly staples like meat are now luxury items, and millions report serious hardship. Cost of living worries – from food to fuel – have been cited repeatedly by protesters and even officials. Public frustration centers on dwindling purchasing power and corruption amid hardship.

Experts and Policy Response

Economists say the rial’s trajectory depends on tackling core issues. As one analysis noted, the currency “remains a barometer of deeper economic strains” – without addressing inflation and fiscal imbalance, the free fall will likely continue. Iran’s new government has proposed limited relief for families. President Masoud Pezeshkian’s cabinet floated a monthly household credit or coupon scheme to cushion the poor. Officials have also offered dialogue; in late December, the president publicly urged ministers to heed “legitimate demands” of shopkeepers and citizens. State media quoted the government acknowledging that protests arise from “pressure on people’s livelihoods”.

“The reimposition of UN sanctions was really the tipping point,” a senior analyst at a Dubai think tank told me earlier. “Without that oil revenue, the Central Bank has no ammunition left to defend the Rial.”

However, analysts say reforms will be politically sensitive. The Central Bank’s complex dual exchange rates remain a challenge. Critics argue that the multi-tier rate system distorts markets and undermines confidence. To stabilize the rial, experts insist Iran needs to curb inflation (through tighter monetary-fiscal policy) and boost foreign inflows – for example, via higher oil output or renewed investment. Some stress that the global context matters: US and Gulf measures also affect Iran. For instance, US tariffs announced on countries trading with Iran add extra pressure on Tehran’s oil exports.

A Bleak Outlook

Iran’s economic outlook for 2026 remains bleak. With sanctions largely in place, production lagging, and the rial’s purchasing power eroded, recovery will be slow. The ongoing protests underscore the risk to domestic stability. “Unless inflation eases materially … pressure on the currency is likely to persist,” warn analysts. In the meantime, every rial devaluation adds to living costs and public discontent. UAE and regional observers will watch closely, given Iran’s role in energy markets and geopolitics.