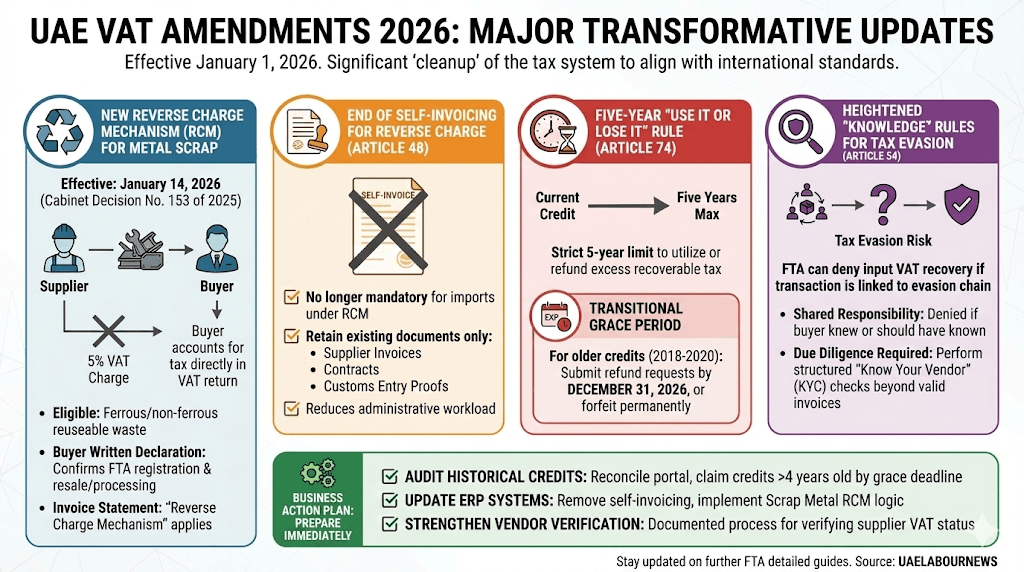

DUBAI, UAE — The Federal Tax Authority (FTA) and the Ministry of Finance have confirmed a series of transformative updates to the UAE’s Value Added Tax (VAT) regime. Effective January 1, 2026, for general amendments and January 14, 2026, for scrap metal regulations, these changes represent the most significant “cleanup” of the tax system since its inception.

From strict refund deadlines to shifting the tax burden in the recycling sector, businesses must prepare for a more rigorous compliance environment. These changes come under Federal Decree-Law No. 16 of 2025, which amends the original 2017 statute to bring UAE tax practices closer to international standards.

Table of Contents

What are the Major UAE VAT Amendments for 2026?

The 2026 reforms are not a total overhaul but a strategic “polishing.” The primary focus is on financial certainty and administrative efficiency. Key highlights include the removal of self-invoicing for imports and a hard deadline for reclaiming old tax credits.

New Reverse Charge Mechanism (RCM) for Metal Scrap

One of the most talked-about updates is Cabinet Decision No. 153 of 2025. It introduces a targeted Reverse Charge Mechanism for the local trading of metal scrap to combat fraud and close loopholes in the recycling sector.

- Effective Date: January 14, 2026.

- The Change: VAT-registered suppliers will no longer charge 5% VAT on scrap metal invoices to other registered businesses. Instead, the buyer must account for the tax directly in their VAT return.

Key Requirements for Scrap Trading:

- Eligible Materials: Ferrous and non-ferrous metal waste that can be reused after processing or recycling.

- Written Declarations: Before the date of supply, the buyer must provide a written declaration to the seller confirming they are registered with the FTA and that the purchase is for resale or processing.

- Invoicing: Sellers must verify the buyer’s registration and include a clear statement on the invoice that the “Reverse Charge Mechanism” applies.

End of Self-Invoicing for Reverse Charge (Article 48)

Starting January 1, 2026, the mandatory requirement to issue “self-invoices” for imports under the reverse charge mechanism is being scrapped.

For years, businesses have had to generate internal invoices purely to satisfy a mechanical compliance requirement. Under the new law, companies only need to retain existing documents: supplier invoices, contracts, and customs entry proofs. This change significantly reduces the administrative workload for businesses regularly dealing with international imports.

The Five-Year “Use It or Lose It” Rule (Article 74

Perhaps the most critical financial change is the introduction of a strict five-year limitation period for reclaiming excess input VAT. Currently, many businesses have allowed credit balances to sit on their FTA portal indefinitely.

- The Expiry: Any excess recoverable tax must be utilized or refunded within five years from the end of the tax period in which it arose. After five years, the right to claim that money is permanently forfeited.

- The Transitional Window: If you have “stagnant” credits dating back to the early years of VAT (2018–2020), the government is offering a one-year grace period. You must submit these refund requests by December 31, 2026, or lose that capital forever.

Heightened “Knowledge” Rules for Tax Evasion (Article 54)

The 2026 amendments significantly raise the bar for supply-chain due diligence. The FTA now has the formal authority to deny input VAT recovery if it establishes that a transaction was part of a “tax evasion chain.”

- Shared Responsibility: Recovery can be disallowed if the buyer knew or should have known that the supply was linked to fraud.

- Due Diligence: It is no longer enough to hold a valid tax invoice. Businesses must now perform structured “Know Your Vendor” (KYC) checks to ensure their suppliers are legitimate and VAT-registered.

What Businesses Should Actually Do Now

Taken together, these updates tighten the margins of UAE tax compliance. Businesses should start preparing immediately by:

- Auditing Historical Credits: Reconcile your FTA portal now and claim any credits older than four years before the 2026 deadline.

- Updating ERP Systems: Adjust accounting workflows to remove self-invoicing requirements and prepare for the specific Scrap Metal RCM logic.

- Strengthening Vendor Verification: Implement a documented process for verifying the VAT status of new suppliers to protect your future input tax claims.

In a Glance:

The Federal Tax Authority is expected to issue further detailed guides before the rules take effect, but the direction of travel is clear: structure and documentation now matter more than ever.